Income Analytics were keen to leverage its twenty years of planning and development expertise

To create an online platform that would enable real estate professionals, investors, owners, and lenders to make better informed data-driven letting, investment, and lending decisions.

The leadership team selected Oakland to build the platform based on our data strategy, cloud engineering, and process transformation expertise.

Now equipped with a modern, easy-to-use platform, Income Analytics has improved its sales effectiveness by demonstrating and customising the application to the specific needs of each target account.

The maturity and commercial benefits of the new platform have enabled Income Analytics to attract significant funding rounds and distribution agreements with industry heavyweights, Savills and MSCI.

Scope

Software Engineering, Modern Application Development, Fast moving data, Product Development, DevOps, Agile working

Technology

Amazon Web Services, Serverless, C#

Project Goal

The goal was to leverage their twenty years of real estate and data expertise to create an online dashboard that would enable real estate professionals, investors, owners and lenders to make better informed data-driven letting, investment and lending decisions.

The company had funding and were ready to move on to the next stage in its evolution. The small team had worked tirelessly to bring this tech startup to market and were seeking a creative solutions partner to capitalise on their cutting–edge business model.

The founders had been refining their concept for years, so they had clear goals of what they wanted from a commercial solution.

The Income Analytics leadership team reached out to The Oakland Group to help transform their earlier concept into a platform for accelerated growth and exceptional customer value.

What was the purpose of the application?

Income Analytics knew that if the commercial real estate sector could gain access to standardised market data and income risk reporting, the industry would be better served, more transparent and attract more investment.

Although the sector frequently used credit scores and ratings, the problem was it did not answer the question of what is the probability of my tenant failing and thus not paying the rent during the term of the lease?

Knowing the percentage probability that a tenant or counterparty in the agreement would go bust would enable better risk analysis and asset management.

Income Analytics knew that business failure data was the best way of providing the required due diligence on tenants and for ongoing risk monitoring of assets, funds and portfolios across the world.

The founders had earlier decided to bring their concept to life with a temporary Excel-based solution of their proprietary rating model and INCANSTM scores. This solution transformed global company credit rating s and finanacial into a unique set of proprietary tenant default risk measures.

Income Analytics was able to interpret the data from the credit reference agencies and convert those numbers into a percentage risk rating that can forecast the long-term probability of rental loss of tenants, assets, funds and portfolios within the commercial real estate sector across the world.

The Challenge

When Income Analytics approached Oakland, its earlier Excel-driven solution had reached the limit of its capabilities.

- Getting good quality data into the system was time-consuming and clunky. Staff had to manually input client portfolio and asset data then match to company credit and financial data from Dun & Bradstreet.

- Clients got weekly updates, so manual data validation was slow and laborious. When source data changed, the Income Analytics team had to email details of the change to clients manually.

- Some of Income Analytics’ clients had hundreds of tenants, so they needed to quickly and visually access their information, putting added pressure on a primarily manual data operation behind the scenes.

- The laborious method of inputting data was costly and time consuming.

The founders wanted to deliver the solution online in real time now that they had proved the model and had clients using their spreadsheet based service. They wanted to utilise the latest data automation, orchestration and quality management techniques in their online product dashboard.

Summary of challenges:

- Data wasn’t being presented in an easy to understand format

- Reports were time-consuming and required manual input to produce

- Customers weren’t able to receive real-time data

- Difficult to store and retrieve historical data

- Labour-intensive manual data input led to an overworked team

- Income Analytics did not have time to grow the business and gain more clients

Building a rapid beta solution

Our goal at Oakland is to build fast and get our client teams engaged early in the solution lifecycle, and this project was no different.

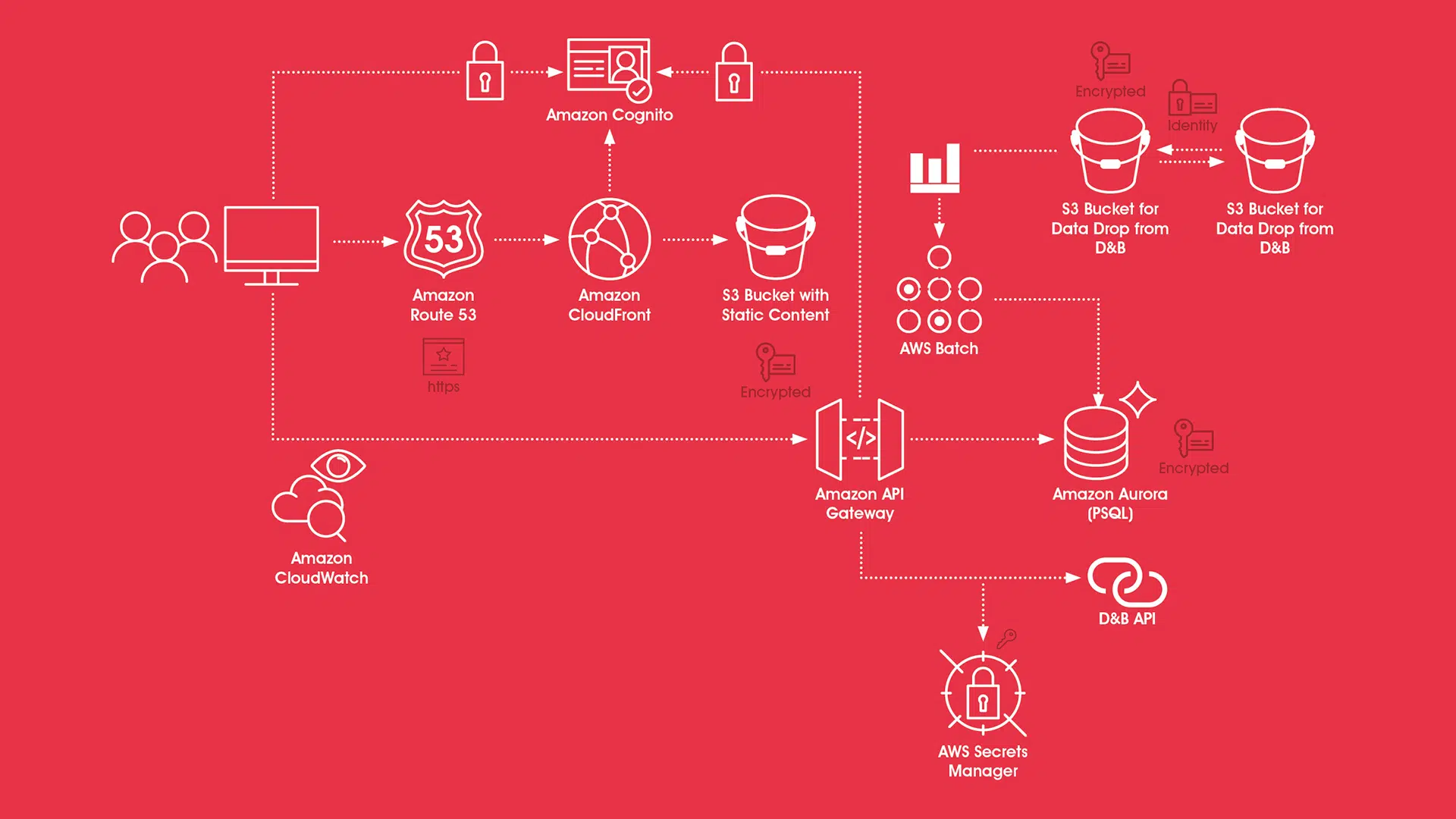

Using an Agile methodology, combined with a React front-end and serverless AWS technology, allowed us to rapidly discover and launch beta features that received feedback in record time.

The Income Analytics and Oakland teams fostered a level of communication that meant changes were often made in hours, not days.

Income Analytics cited our technology expertise, agility, speed, and pragmatic approach to product revisions as some of the reasons we were one of the best technology companies they had ever worked with.

Leveraging the next generation of data technology

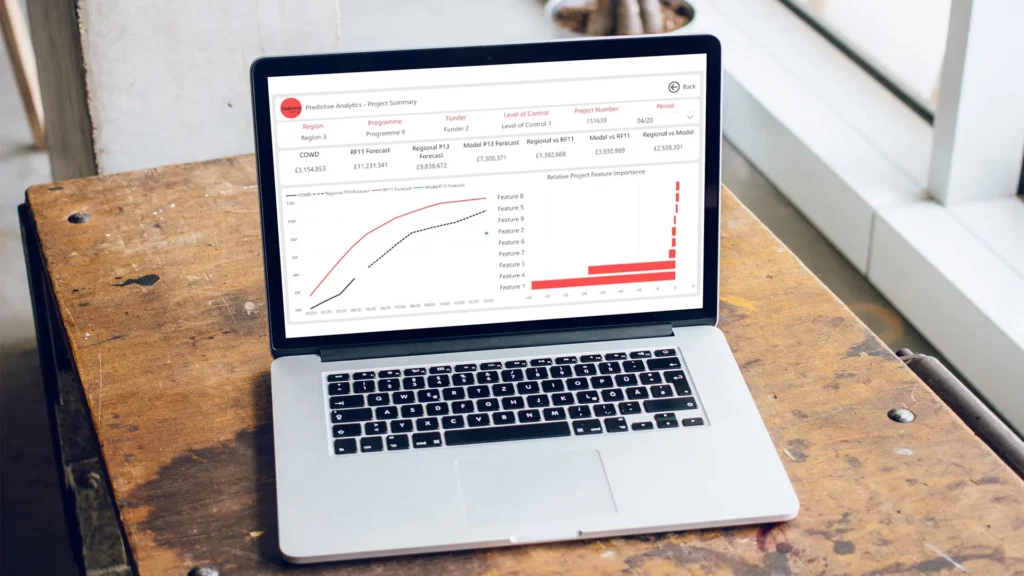

We started with a small proof of concept that began transforming their complex system of spreadsheets into a modern application, leveraging a cloud architecture to create a modern platform for continued innovations such as machine learning and predictive analytics.

Driving down costs

To speed up the development process (and reduce technology costs for the client), Oakland designed the solution to leverage AWS serverless technology. This decision means the client only paid for the limited usage required during the build phase and now only pays for whatever resources they consume.

Faster automation drives smarter decisions

The platform now continuously monitors various Dun and Bradstreet data sources such as tenant data, company data, corporate family tree data, historical scores and financial data, automatically feeding updates directly into the Income Analytics platform.

This combination of automation and direct integration has eliminated the need for costly manual interventions and lengthy delays. Customers now access the INCANSTM scores and data 24/7, confident it is always timely, accurate and complete.

Leveraging the next-generation data platform also means we can innovate changes much faster. We’re currently building new features that give customers a historical view of all the changes in their data and predictive analytics driven by machine learning.

Delivering incremental commercial value

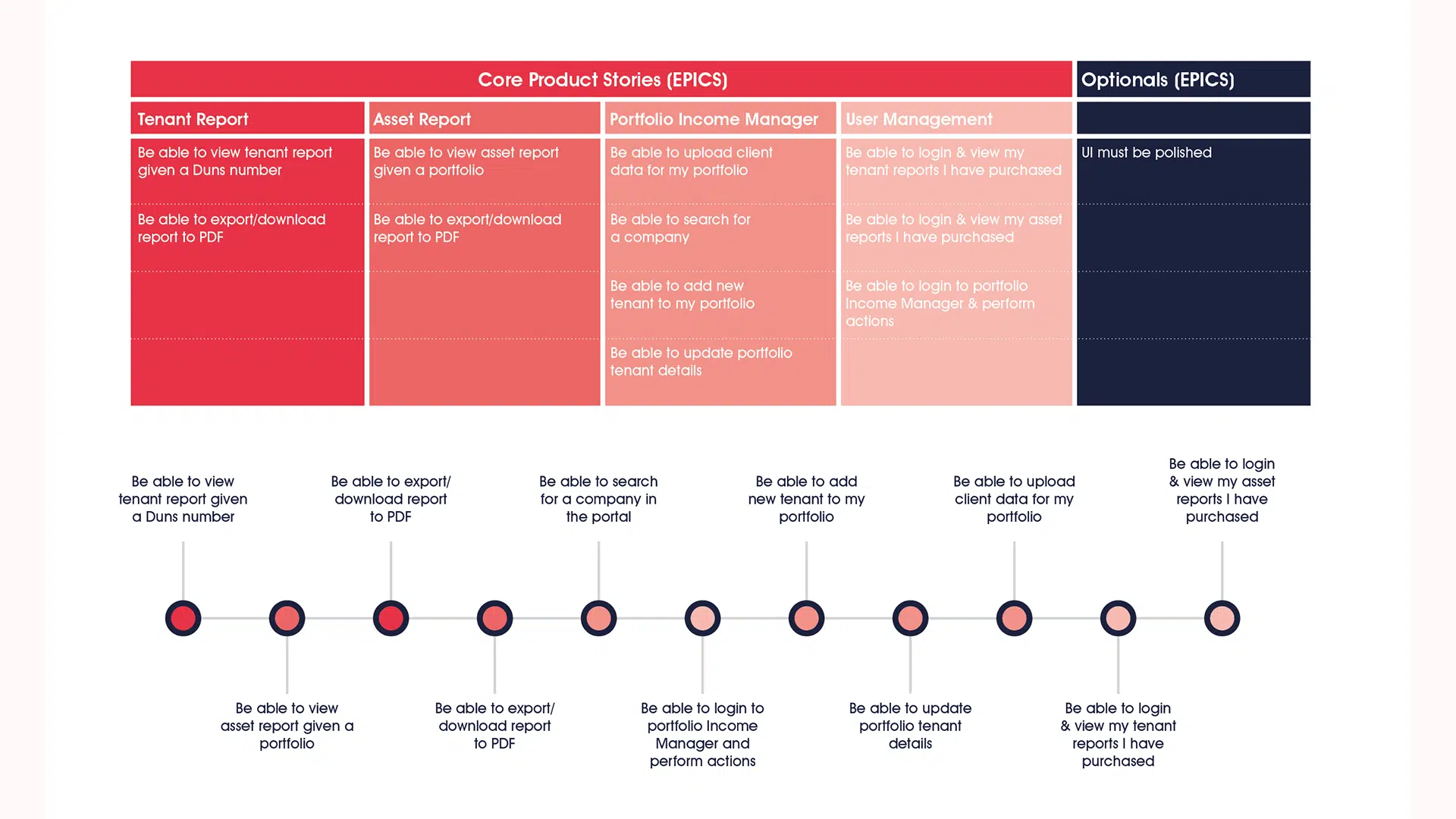

We designed a solution roadmap that ensured the business could benefit commercially from each significant release instead of waiting long periods to recoup their investment.

The roadmap we helped to deliver focused on the following milestones:

- Tenant Report – Identification checks, quality of covenant and probability of default along with the usual company financials

- Asset Report – Aggregated income stream analysis and assessment of the probability of loss

- Portfolio Income Manager – Platform to view and monitor the financial health of existing tenant and portfolio income quality 24/7

- User Management / Administration – Careful implementation of user administration functions, ensuring excellent client service

Building an application for the end-user in mind

Income Analytics are no stranger to working with technology teams and had a clear idea of what they wanted from the application.

Nevertheless, due to our obsession with user experience and customer journey design, Oakland made a string of recommendations and improvements to the overall look and usability of the product to exploit the benefits of developing with a modern data platform and interface.

What has been the outcome for Income Analytics?

Catalyst for growth

Running a startup is stressful and time-consuming.

It can be challenging to grow and scale a business when the leadership team is hands-on, building solutions and fighting fires every day.

Once the founders knew the technology was in safe hands, they could concentrate on growing the business and have since increased their client base from 10 to 30.

Combined with a sharp rise in customer growth, the Income Analytics team has also grown quickly, increasing from 3 to 10 staff.

Increased sales enablement and funding

Now equipped with a modern, easy to use platform, Income Analytics has improved its sales effectiveness by demonstrating and customising the application to the specific needs of each target account.

The maturity and commercial benefits of the new platform has also enabled Income Analytics to attract a significant funding round and distribution agreement with industry heavyweights, Savills and MSCI.

Savills will adopt the Income Analytics product across its valuation, capital markets, agency and investment management teams.

MSCI has entered into a distribution agreement with Income Analytics to help MSCI customers develop a greater understanding of their portfolios, further validating the quality of the solution and its impact on the real-estate sector.

It’s a great vote of confidence in the product… that both MSCI and Savills, which are globally recognised names in property analytics and commercial real estate investment respectively, have backed us as investors and distribution partners.

– Matthew Richardson, Founder and CEO of Income Analytics